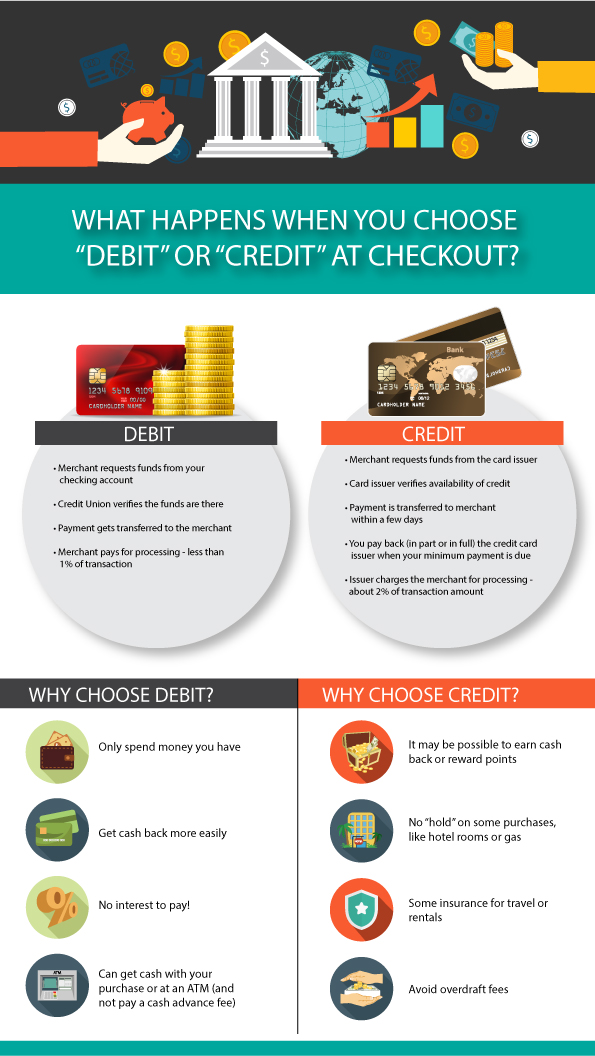

Debit Vs. Credit at Checkout

You can enjoy the convenience of using a debit card or credit card when you checkout at a merchant, but there are some important differences between using debit vs. credit at checkout.

Using Debit at Checkout:

- Merchant requests funds from your checking account

- Credit Union verifies the funds are there

- The payment gets transferred to the merchant

- The merchant pays for processing – less than 1% of the transaction

Using Credit at Checkout:

- Merchant requests funds from the card issuer

- Card issuer verifies the availability of credit

- Payment is transferred to the merchant within a few days

- You pay back (in part or in full) the credit card issuer when your minimum payment is due

- The issuer charges the merchant for processing – about 2% of the transaction amount

Why Choose Debit?

- Only spend money you have

- Get cashback more easily

- No interest to pay

- Can get cash with your purchase or at an ATM (and not pay a cash advance fee)

Why Choose Credit?

- It may be possible to earn cashback or reward points

- No hold on some purchases – like hotel rooms or gas

- Some insurance for travel or rentals

- Avoid overdraft fees

Contact us if you have questions or need more information about the difference between debit and credit.

If you like what you read, then join our e-mail list!